How to define your exit strategy

Feb 20, 2025

Author: Leanne Knowles

3-4 minute read

How your exit plan sets you up for a freedom business

Ready to stop winging it and start building your business with the endgame in mind?

This article walks you through how to define a smart, simple exit strategy—whether you want to sell, scale back, or step out without burning the whole thing down.

We’ll cover the essential decisions, key financial moves, and system upgrades that help you maximise value, protect your lifestyle, and build a business that’s actually sellable. Designed for service and creative business owners who want freedom without the fizzle.

What is your business end game?

How will you set the business up to enable its legacy beyond you? The end game is a simple way to describe what you are creating and – and how you plan to exit.

Why is it important

Planning for an exit strategy is crucial for small business owners aiming to maximise their business's value and ensure a smooth transition. However, many owners overlook this aspect, which can lead to significant challenges.

Benefits of exit planning:

- Enhanced business value: A well-structured exit plan can increase the attractiveness of a business to potential buyers, potentially leading to a higher sale price.

- Smoother transition: Exit planning facilitates a seamless transition, ensuring that operations continue without disruption and preserving the business's legacy.

- Financial security: Owners with exit strategies are better prepared to secure their financial future post-transition.

Consequences of not having an exit plan:

- Missed opportunities: Without an exit plan, owners may miss optimal opportunities to sell or transition their business, potentially resulting in a lower valuation.

- Operational disruptions: The absence of a succession plan can lead to operational challenges, affecting the business's stability during the transition.

- Financial uncertainty: Owners without exit strategies may face financial instability upon exiting, lacking a clear plan for their post-business life.

In summary, proactive exit planning is essential for small business owners to maximise value, ensure operational continuity, and secure financial stability during the transition.

How planning for exit works

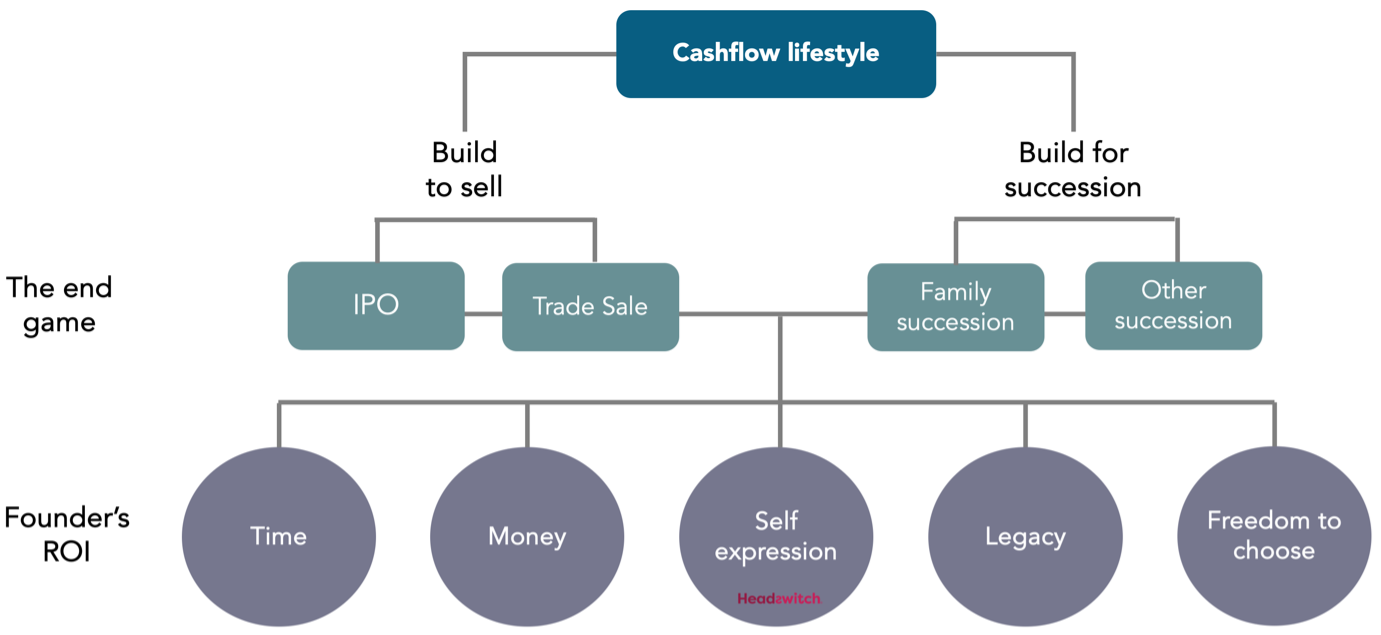

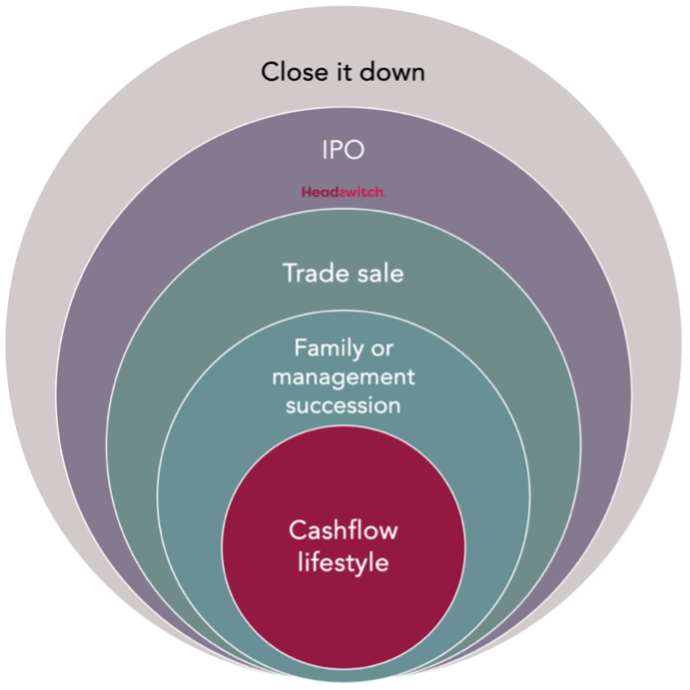

These outcomes each align with different goals, so choosing the right one depends on your long-term vision for the business and your personal objectives.

Exit options

There are common business structures that help you deliver your end game. They are summarised here:

- Cashflow lifestyle

- Family succession

- Staff/management buyout

- Trade sale

- IPO

- Close it down

Clarifying your end game

When you are crystal clear about how the end game looks, you can focus your time and energy, and marshal all your people and resources towards that goal. The outcome you choose now may change over time, depending on opportunities and circumstances that arise through the life of your business. You can make that shift later if you need to.

Exiting a business can take many forms, depending on your goals, market conditions, and personal circumstances. Each option has its own pros, cons, and implications for your financial and personal goals.

Here are the primary options:

-

Cash lifestyle business

Instead of selling, you optimise your business for recurring income while stepping back from day-to-day operations. This provides ongoing financial freedom but requires systems and management in place to function without you.

- Purpose: prioritise personal freedom, work-life balance, and steady income over scaling the business.

- Pros: flexible, low pressure, owner retains control, and minimal reinvestment required.

- Cons: limited growth potential, harder to sell, and income is tied to the owner’s active involvement.

When you’re creating a cashflow and lifestyle business, there’s no need to be thinking small, like in the old days. You can create big revenue, without having a big business machine to manage, and a recurring revenue system is the answer. No more slogging away trying to make ends meet, and worrying about having enough time to get everything done. Your recurring revenue system can deliver 24/7 cashflow into your bank account, even while you sleep.

-

Trade sale

A trade sale is about selling your business to another company, often in the same industry. This option allows you to cash out, often at a premium, if your business offers strategic value to the buyer.

- Purpose: realise value and exit the business, typically for a lump sum.

- Pros: potentially high payout, buyer benefits from synergies, and a clean exit for the owner.

- Cons: time-consuming process, risk of cultural misalignment, and potential loss of legacy.

Building a business to sell is the dream of many, but so few manage to make it happen, particularly when it’s a service or creative business. Even when someone does find a buyer, it’s traditionally difficult to achieve the financial result that will make you happy.

Recurring revenue is highly valued in business for obvious reasons. In addition to 24/7 money while you sleep, it increases the level of confidence that a future buyer has in their ability to maintain existing revenues, and then be able to grow and scale the business even further. It can transform your business into hot property.

-

Family succession

Handing the reins to a family member ensures the business stays within the family. It requires careful planning, clear communication, and training to avoid succession disputes or failures.

- Purpose: preserve the family legacy and ensure continuity.

- Pros: maintains family ownership, preserves business culture, and may reduce transition costs.

- Cons: requires capable successors, potential family conflict, and emotional challenges in decision-making.

If you’re planning on family success, the transition becomes easier when your knowledge and core intellectual property is captured in multi-media format, and delivered via a high performance, automated sales and marketing system. so the next generation can continue to deliver the same powerful service to your customers, while you enjoy your golf retreat, your European cruise, or your motorcycle adventure in Nepal.

-

Management buyout

A management buyout (MBO) sells your business to your existing management team. This provides continuity for employees and customers and rewards those who’ve been instrumental in the business’s success.

- Purpose: ensure continuity while transferring ownership to those already running the business.

- Pros: smooth transition, motivated buyers, and retains institutional knowledge.

- Cons: may require external financing, potential strain on buyer-seller relationships, and limited market exposure.

-

Initial public offering (IPO)

An IPO takes your company public by offering shares to the public. This is ideal for businesses with significant growth potential but involves heavy financial and regulatory complexities.

- Purpose: raise capital, enhance visibility, and allow early investors to cash out.

- Pros: access to significant funding, increased credibility, and liquidity for shareholders.

- Cons: expensive, highly regulated, and puts pressure on performance due to shareholder expectations.

Taking a business to IPO is not for the faint hearted, but some businesses need to consider this as an option for the future. A potentially high growth business that involves lots of R&D and capital intensive investment, such as manufacturing, medical, defence or high technology endeavours, will need to create an exit or liquidity event for early investors. This enables the shareholders to secure an early return on investment, rather than waiting for decades.

A business with recurring revenue will usually bring greater value to the result of an IPO, because investors will be looking for elements of a strong business model, that they can have confidence in for a future return on investment.

-

Close it down

Shutting down and liquidating assets can be the best option if the business is no longer profitable or viable, but it requires careful planning to minimise losses and liabilities. In this case, you would wind up operations, settle debts, before formally shutting the business.

- Purpose: To end the business when it has served its purpose, or when continuing it no longer aligns with the owner’s goals, market conditions, or profitability.

Why would you do it?

There are a few reasons you might end up doing this. Maybe the business has met its financial or personal goals, and there’s no desire or need to continue. Often it happens when you don't feel like you have a choice.

- Market shifts or declining profitability make continuation unviable.

- Personal priorities, like retirement or a career change take precedence.

- Lack of a suitable buyer, successor, or alternative exit strategy.

Pros:

You can normally find a positive in every situation

- Clean exit: Provides closure and allows the owner to move on without lingering obligations.

- Cost savings: Avoids ongoing operational costs when the business is no longer profitable or sustainable.

- Control: Allows the owner to dictate the terms of the closure without external influence.

Cons:

Here is the potential downside of leaving your exit planning to a close down.

- Lost value: Assets or goodwill built over time may go unused or unrecovered.

- Reputational impact: May raise questions among stakeholders, especially if closure appears sudden.

- Emotional toll: Ending a venture can feel like a failure, even when it’s a strategic decision.

Closing down a business may not be a negative outcome—it can be a strategic, empowering choice when it aligns with your goals and circumstances.

What you can expect

Leanne isn’t just about business growth—she’s about bold, unstoppable momentum.

From pro skydiver to business strategist, Leanne launched and sold two adventure sports businesses before turning 35. In 2000, she founded Headswitch, helping small business owners in low-tech industries scale fast using smart, tech-enabled strategies.

Her approach? No messing around, just proven tactics. She’s built and sold businesses without drowning in stress—and now she helps other founders do the same. Through online training and two powerful freedom business frameworks - The Service eCommerce Headswitch, and The 3 Revenue Streams frameworks, Leanne is changing the way small business owners life, create and succeed. She is building a community of ambitious business owners who are done with outdated models and ready to build businesses that give them real freedom.

Get the inside edge

Want cutting-edge strategies and step-by-step guidance to build a business that practically runs itself —paying you while you sleep? Get the inside edge now.

And don’t worry, your info stays safe. No spam, no inappropriate sharing, just game-changing insights.

We hate SPAM. We will never sell your information, for any reason.